What is a Health Savings Account (HSA)?

A Health Savings Account, or HSA, is an account often offered by employers or to individuals when they elect a high deductible health plan, or HDHP. This savings account allows you to set aside pre-tax dollars to be used for qualified medical expenses, which are defined by the IRS. The maximum annual contribution in 2023 for an HSA is $3,850 for an individual or $7,750 for a family. Those age 55 or older can contribute an additional $1,000.

What is a Flexible Spending Account (FSA)?

A Flexible Savings Account, or FSA, is another savings account that allows you to set aside pre-tax dollars for certain medical expenses defined by the IRS. It is an account offered and owned by employers. It allows you to be reimbursed for qualified medical expenses up to the annual contribution amount at any time, regardless of how much has been contributed at that point. The maximum contributions for 2023 are $3,050.

1

Book on our free mobile app or website.

Our doctors operate in all 50 states and same day appointments are available every 15 minutes.

2

See a doctor, get treatment and a prescription at your local pharmacy.

3

Use your health insurance just like you normally would to see your doctor.

How Does an FSA Work?

An FSA is a plan set by your employer that allows your employer to withhold a specified amount from your pay to be set aside, tax-free, to pay for qualified medical expenses. You cannot use an FSA if you are self-employed.

Both you and your employer can contribute to your flexible savings account, and your employer’s contributions will not be included as part of your gross income. You must use the contributions to your FSA during the plan year.

How Does an HSA Work?

An HSA works by establishing an account with a trustee approved by the IRS, to set aside pre-tax funds to be used to pay for qualified medical expenses. You are only eligible for a health saving account if you choose to be covered under a high deductible health plan, or HDHP.

You, your employer, or anyone else, such as a family member, can contribute to your health savings account. Your employer’s contributions are not included as part of your gross income. Any funds in your HSA will remain there until used.

You can sign up for a health savings account or flexible spending account during the Open Enrollment period for health insurance. Read more about Open Enrollment.

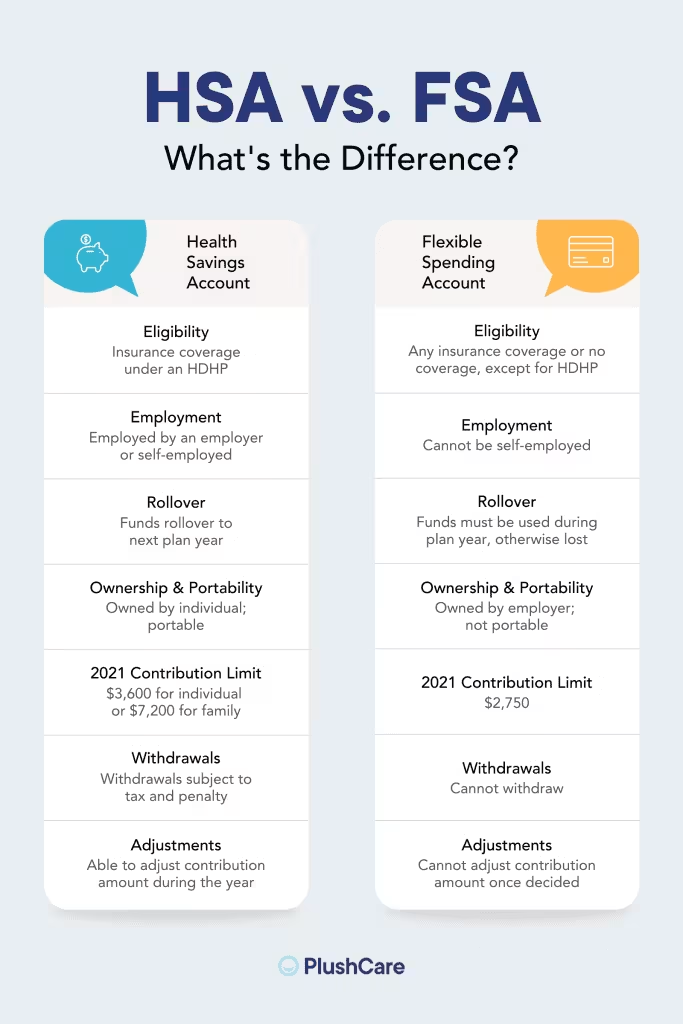

HSA vs. FSA

There are notable differences between an HSA vs. an FSA. In terms of eligibility, you are only eligible for an HSA under an HDHP, or high deductible health plan. You can have an HSA if you are self-employed. Anyone, regardless of insurance coverage, is eligible for an FSA, if your employer offers this option, unless you are covered under an HDHP. However, you cannot have an FSA if you are self-employed.

Funds contributed to a health savings account can rollover to the next plan year if left unused. On the other hand, funds contributed to a flexible savings account usually, except for a few exceptions, must be used during the coverage year. Otherwise, you will lose the FSA funds.

Both HSA and FSA contributions can be used to cover telehealth visits, such as PlushCare visits. Do you want to use your funds to book an appointment with one of our doctors online today? Book an online appointment at PlushCare below.

1

Book on our free mobile app or website.

Our doctors operate in all 50 states and same day appointments are available every 15 minutes.

2

See a doctor, get treatment and a prescription at your local pharmacy.

3

Use your health insurance just like you normally would to see your doctor.

The individual owns an HSA, while the employer owns an FSA. Health savings accounts are portable, meaning that regardless of whether you change jobs or become unemployed, you can keep them. Flexible savings accounts, however, are not portable, meaning that you will lose the account if you leave your job.

Both HSAs and FSAs allow you to use the contributions for qualified medical expenses, tax-free. However, both have maximum limits on the amount you can contribute. The maximum annual limit for an FSA is lower than the maximum annual limit for an HSA.

These limits are set by the IRS and can vary from year to year. In 2023, the limit is $3,850 for an individual HSA, $7,750 for a family HSA, and $3,050 for an FSA.

You can withdraw funds from an HSA, although there is a tax and penalty fee. You cannot withdraw from an FSA. You can access the annual contribution to your FSA at any time regardless of your contribution at that point, but you can only access what has already been contributed to your HSA at any point. You can change your contribution amount at any time during the year for a health savings account, but not for a flexible savings account.

HSA | FSA | |

|---|---|---|

Eligibility | Insurance coverage under an HDHP | Any insurance coverage or no coverage, except for HDHP |

Employment | Employed by an employer or self-employed | Cannot be self-employed |

Rollover | Funds rollover to next plan year | Funds must be used during plan year, otherwise lost |

Ownership & Portability | Owned by individual; portable | Owned by employer; not portable |

2023 Contribution Limit | $3,850 for individual or $7,750 for family | $3,050 |

Withdrawals | Withdrawals subject to tax and penalty | Cannot withdraw |

Withdrawals | Able to adjust contribution amount during the year | Cannot adjust contribution amount once decided |

Is an HSA or FSA Better?

Whether an HSA or FSA is better depends on how you are planning to use your funds from the savings accounts and what kind of healthcare coverage you have. Both of these accounts have their own advantages and disadvantages. You are only eligible for an HSA under an HDHP, or high deductible health plan.You are only eligible for an FSA if your employer offers the option.

So if you require regular, expensive medical care other than preventative care, or you have a chronic illness, an HDHP may not be the best plan for you. Because HDHPs have a higher deductible, there would be larger out of pocket expenses.

An FSA, however, can be used regardless of whether you have an insurance plan or not, unless you are covered under an HDHP or are self-employed. Generally, an FSA can only be used to cover expenses incurred during your coverage year, so any unused funds at the end of the year will be lost.

For this reason, it is important to only contribute an amount that you plan to spend for qualified medical expenses that year, to your flexible savings account. On the other hand, any unused funds contributed to an HSA can continue to rollover to the next year.

Is an HSA Use it or Lose it?

An HSA is not use it or lose it, unlike an FSA. Any funds put into your HSA will remain there until used. Contributions to your health savings account will rollover to the next plan year and continue to accumulate interest, which is also tax-free.

In addition, even if you change jobs or become unemployed, you can keep your HSA. In this way, a health savings account is portable, while a flexible spending account is not. If you have an FSA and change jobs, you will lose that account.

Can You Have Both an HSA and FSA?

You can only qualify for an HSA if you are covered under an HDHP, or high deductible health plan, that is eligible for a health savings account. If you have both an HDHP and an FSA, you generally cannot contribute to an HSA.

However, there are certain exceptions. With specific types of plans, such as having an HDHP as well as a limited purpose FSA or post-deductible FSA, it is possible to contribute to an HSA.

What Products are HSA Eligible?

Products that are HSA eligible include qualified medical expenses accumulated after the HSA has been established. You can use funds from your health savings account, tax-free, to pay for those expenses specified by your plan or the IRS. These HSA funds can pay for you, your spouse, or your dependents’ medical expenses.

These qualified expenses include medical and dental deductibles, copayments, and coinsurance, among other expenses. Premiums are not HSA eligible, except under certain conditions, such as long term care insurance, continuation of healthcare coverage, Medicare for those 65 and older, and health coverage while receiving unemployment benefits.

Do you want to learn more about the differences between copay and coinsurance? Read about copay vs coinsurance.

What Products are FSA Eligible?

Products that are FSA eligible include qualified medical expenses acquired during the plan year. Usually, funds from an FSA can only be used to reimburse those expenses. These expenses are often paid for with a debit, credit, or other spending card from your employer.

1

Book on our free mobile app or website.

Our doctors operate in all 50 states and same day appointments are available every 15 minutes.

2

See a doctor, get treatment and a prescription at your local pharmacy.

3

Use your health insurance just like you normally would to see your doctor.

HSA/FSA and Telehealth

Insurance coverage for telehealth varies by state, but telehealth is covered in most states. You can even use Medicare and Medicare Advantage to pay for telehealth visits.

Read: What is Telehealth?

HSA and FSA funds can usually be used to pay for telehealth visits, provided that they are medically essential, replacing in person visits. As a result of updates to the CARES Act in 2020, you can be covered for telehealth services and still contribute to an HSA, as long as you are also covered under an eligible HDHP.

Patients can use HSA and FSA funds to cover PlushCare visits, although these funds cannot be used for PlushCare membership costs. PlushCare patients can also use FSA and HSA distributions to cover drugs prescribed by a PlushCare doctor, as well as to cover lab costs if referred by a PlushCare doctor.

Are you looking to use your HSA or FSA funds for a PlushCare visit? Book an appointment online today.

Read More About Health Insurance and Telehealth

Sources:

PlushCare is dedicated to providing you with accurate and trustworthy health information.

ConnectYourCare. What Is Telehealth and Is It Covered by FSA or HSA Funds? Accessed November 4, 2021. https://www.connectyourcare.com/blog/what-is-telehealth-and-is-it-covered-by-fsa-or-hsa-funds/

HealthCare.gov. Health Care Options, Using a Flexible Spending Account FSA. Accessed November 4, 2021. https://www.healthcare.gov/have-job-based-coverage/flexible-spending-accounts/

HealthCare.gov. What are the benefits of enrolling in HDHPs & HSAs? Accessed November 4, 2021. https://www.healthcare.gov/high-deductible-health-plan/hdhp-hsa-information/

Investopedia. Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs). Accessed November 4, 2021. https://www.investopedia.com/insurance/hsa-vs-fsa/

IRS.gov. Publication 969 (2020), Health Savings Accounts and Other Tax-Favored Health Plans. Accessed November 4, 2021. https://www.irs.gov/publications/p969#en_US_2015_publink1000204174